Post Office PPF Scheme: For countless individuals and families across India, financial planning begins with a simple, trusted choice: the Post Office Public Provident Fund (PPF). This scheme represents more than just numbers on a passbook; it is a commitment to one’s own future, a disciplined pact between the saver and their aspirations. In an economic landscape filled with uncertainty, the PPF stands out as a beacon of stability, backed by the sovereign guarantee of the government. It is a foundational tool for turning dreams of a secure retirement, a child’s education, or a family milestone into a tangible, achievable reality.

A Commitment to Your Future Self

The PPF is thoughtfully designed for the long journey. With a core tenure of 15 years, it encourages a perspective that looks beyond monthly budgets to lifelong security. This extended timeframe is not a restriction, but a framework that nurtures patience and consistency—virtues essential for meaningful wealth creation. Furthermore, the scheme recognizes that life doesn’t end at 15 years; it allows you to extend your account in blocks of five years indefinitely. This adaptability makes it a lifelong financial companion, capable of supporting you from your peak earning years into a peaceful retirement.

The Quiet Magic of Compounding Interest

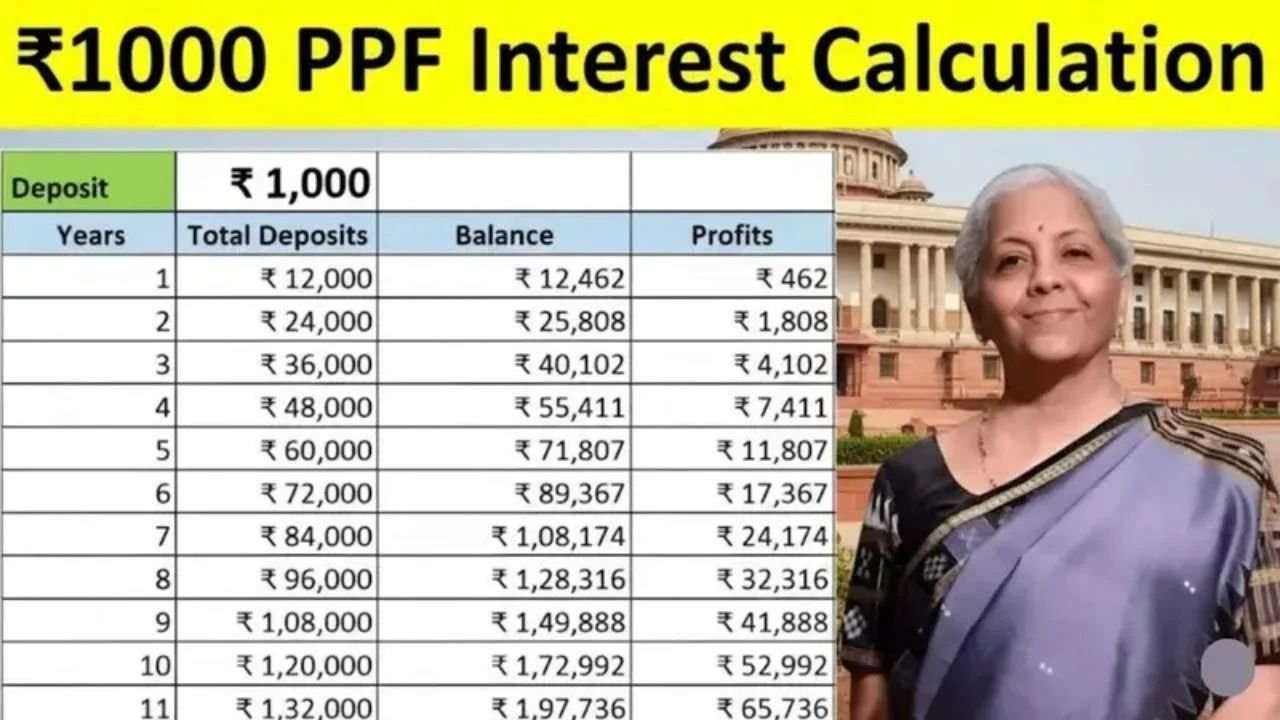

At the heart of the PPF’s growth story is the principle of compounding, currently working at an annual interest rate of 7.1%. Imagine planting a single seed and watching it grow into a tree that itself produces more seeds, season after season. Compounding works in a similar way, calculating interest each year not just on your deposits, but also on the interest already earned. Over a decade and a half, this process transforms steady, annual contributions into a substantially larger corpus. It’s a quiet, automated form of growth that rewards those who start early and stay the course.

To visualize this journey, consider the path of a dedicated saver. An individual who commits to investing ₹25,000 each year for the full 15-year tenure would contribute a total of ₹3,75,000. Through the sustained power of compounding at the current rate, this disciplined saving could potentially grow to an approximate maturity value of ₹6,78,000, with interest earned forming a significant portion of the total. This pattern scales with your capacity: doubling the annual investment can potentially double the outcome, illustrating the direct relationship between your commitment and your financial harvest.

The Unparalleled Benefit of Complete Tax Efficiency

One of the most compelling features of the PPF is its impeccable tax status, known as Exempt-Exempt-Exempt (EEE). This means it offers a shield at every stage of your investment lifecycle. First, your annual deposits, up to ₹1.5 lakh, qualify for a deduction under Section 80C of the Income Tax Act, reducing your taxable income today. Second, the interest that accrues in your account each year is entirely tax-free, unlike many other fixed-income instruments. Finally, upon maturity, the entire lump sum you receive—every rupee of principal and interest—is yours to keep without any tax liability. This triple-layer protection ensures that the returns you project are the wealth you actually accumulate.

Designed for Real Life Flexibility When You Need It

While the PPF encourages a long-term outlook, it is built with an understanding of life’s unpredictability. The scheme provides thoughtful avenues for access without dismantling your goal. From the seventh financial year onward, you can make partial withdrawals subject to specific conditions and limits. Earlier, between the third and sixth years, you have the option to take a loan against your balance, offering a bridge during financial shortfalls. And at maturity, you are presented with a choice: to extend the account and continue contributing, or to let your hard-earned corpus rest and continue earning tax-free interest without further deposits.

Who Finds a Trusted Friend in the PPF?

The PPF’s unique blend of safety, growth, and tax efficiency makes it a universal fit for a wide spectrum of savers. It is an ideal cornerstone for salaried employees building a retirement fund alongside their EPF. For self-employed professionals and business owners, it serves as a structured, disciplined pension plan they create for themselves. Parents charting a 15-year course toward a child’s university education or wedding find its predictability invaluable. Ultimately, it is a perfect match for any prudent individual who values the peace of mind that comes with guaranteed, tax-free growth, forming the secure base of a larger, diversified financial portfolio.

In essence, the Post Office PPF is a testament to the profound impact of steady, faithful saving. It may not promise overnight riches, but it offers something far more enduring: a predictable and secure path to financial well-being. By choosing to invest in it, you are not just allocating money; you are planting seeds for a future where your goals are within reach, supported by the quiet, relentless power of time and compound interest.